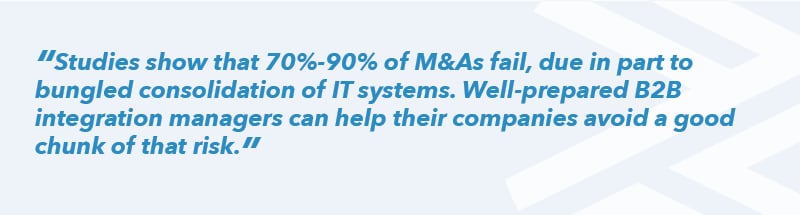

A well-executed M&A can reduce costs, eliminate competition, and set up the merged entity for market-dominating success. Yet 70%-90% of M&As fail, due in part to bungled consolidation of IT systems. Well-prepared B2B integration managers can help their companies avoid a good chunk of that risk, so the past doesn’t become prologue.

This article breaks down the risks to EDI/B2B data flows post-merger, and how integration leaders can help ensure business as usual on Legal Day One. We also examine the most important factors to consider when selecting which integration platform the merged entity will anchor the combined company’s operations.

By the way, for those who didn’t graduate from business school, Legal Day One is the day the acquired company ceases to exist as a separate entity and the acquiring or merged company assumes new responsibilities and financial liabilities.

In short, Legal Day One is the start of combined operations. Relentless planning is required for that day to become the dawn of a new era and not the day everything goes off the rails.

This is one of several articles in our series on Integration Resiliency. It contains lessons from our experience supporting the data integration challenges of organizations during periods of M&A activity. You’ll find links to the other articles at the end.

Lesson 1: Remember EDI/B2B Data Flows are the Business

Every business manager knows that orders, shipments, invoices, and acknowledgments drive operations and revenue. But not everyone of them knows that none of those things happen without EDI.

That’s because, as EDI and B2B integration specialists know, EDI is how businesses automatically exchange mission-critical documents (e.g., purchase orders and invoices). On Day One, those documents must continue to flow uninterrupted to maintain the “business as usual” expectations of trading partners and customers.

But post-merger, business unit leaders will typically push for speedy consolidation before the combined integration ecosystem is de-risked. Maintaining flawless (or as close to flawless as possible) B2B data flows throughout consolidation may require integration platform redundancy.

Lesson 2: You’re Operating Two Integration Environments (And That’s OK for Now)

While supporting two integration environments isn’t efficient long-term, it’s often necessary to maintain business continuity while you inventory, manage, and plan consolidation.

It’s not uncommon for integrations to rely on a transition period where dependencies remain in place while the combined organization stabilizes. Often, companies manage these dependencies via TSAs (Transition Service Agreements).

Running two platforms to maintain continuity is easier if you keep everyone working from the same playbook:

Dual-Run Success Looks Like:

One shared partner inventory: One source of truth for partner IDs, endpoints/protocols, document types, contacts, and criticality.

One owner per partner: A named quarterback and a clear escalation path—no “that’s the other stack.”

One incident playbook: Same severity levels, triage steps, and recovery options (replay, reroute, rollback).

One set of operating rules: Standard change control for partner-facing changes, with a rollback plan required.

One visibility view: Ideally, one dashboard; if not, one daily health/exceptions report that covers both platforms.

Lesson 3: Two of Everything Creates Operational Risks to Manage

Maintaining two environments means duplicated controls, duplicated partner configs, and duplicated security surfaces. This creates specific failure modes that you can predict and prevent:

Control-number / identifier collisions: Standardize partner identifiers and interchange conventions early (ISA/GS IDs, internal partner IDs, control number ranges, acknowledgment routing rules) and enforce them through change control so “ghost failures” don’t emerge from mixed conventions.

AS2 and certificate outages: Centralize certificate and endpoint ownership, maintain a single certificate inventory with renewal dates, and require a cutover checklist (partner notification, testing plan, rollback steps) for any AS2 endpoint or certificate change.

Partner definition/config drift: Treat trading partner profiles/configs as governed assets—set a “no ad hoc edits” rule, keep configuration in a controlled repository (exported configs + version history), and require peer review for partner profile changes so a “quick fix” doesn’t break working communications.

Visibility fragmentation: Establish one incident workflow and one health view across both platforms (or one shared daily exception report if tooling can’t be unified), standardize alert thresholds and retry rules where possible, and assign clear ownership so detection and recovery don’t depend on which stack someone happens to be watching.

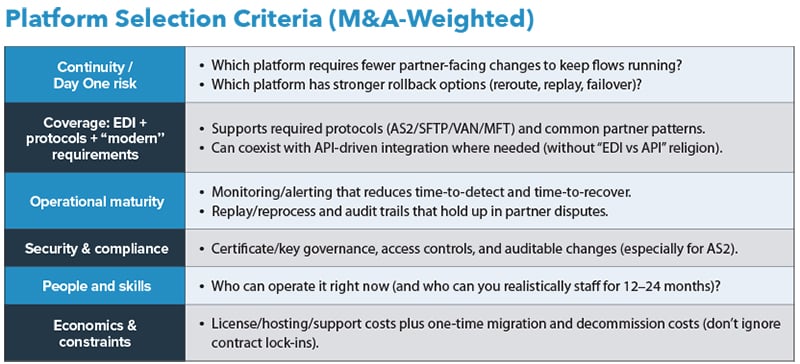

Lesson 4: Score the EDI/B2B Platforms Against the Criteria that Matter in M&A

If possible, try to avoid picking the surviving platform by post-merger politics or licensing alone. Instead, use an application rationalization approach.

Application rationalization means deciding what to keep/replace/retire/consolidate based on an inventory plus business value and TCO. How’s that relevant to B2B integration?

Continuity risk is a risk to business value because trading partner-facing breakage hits revenue and operations first. To speed the platform decision and mitigate the risk, consider using a criteria model you can defend, and your team can execute that looks like this:

Lesson 5: Build a Hub, Then Migrate in Waves

Build a consolidation plan around the concept of “stability first, synergy later.” Create a controlled integration hub layer (visibility + governance), then migrate partners in waves to reduce disruption.

A B2B integration hub is commonly defined as a central platform that manages partner/system exchange using EDI, APIs, or MFT—standardizing routing and security. Wave migration prevents a single cutover from becoming a business-wide event. You segment partners by criticality/complexity and move low-risk ones first.

Also, use TSA/dual-run intentionally: keep what must run, while you drain traffic toward the chosen hub/platform with a clear retirement plan. Lastly, make partner communications and testing capacity part of the plan, not an afterthought.

Remedi Understands Post-Merger B2B Integration Support Needs

Misaligned cultures can harm M&As, but most often, they fail because of poor IT integration, including EDI/B2B data platforms. This can cause trading partner traffic to get disrupted, leaving teams unable to recover quickly.

If you’re staring down dual environments, partner migrations, and a platform consolidation decision, reach out here. Remedi can provide experienced B2B integration resources (internal, external, or hybrid) to help you keep business running while you transition from dual-run to a consolidated platform.

Other Blogs in the Integration Resilience Series:

How EDI Managers Can Meet Pressure to Deliver Results Without Adding Headcount

What is Failure to Deliver Syndrome (FTDS) and How Can You Avoid It?

How EDI Teams Support Efficient Platform Migrations and Revenue Growth

What Are the Risks of Legacy EDI Systems?

How to Modernize B2B Integration Stacks while Managing The Challenges Involved

How a 20th Century Technology Has Evolved to Meet 21st Century Needs

FAQ's

Q1: What is “Legal Day One”?

A: Legal Day One is the date the acquired company is now part of the combined legal entity. From that point forward, the merged organization owns the operational consequences of anything that disrupts business as usual.

Q2: Why should B2B integration leaders care about Legal Day One?

A: Trading partners don’t pause their requirements when a deal closes. Orders, shipments, invoices, and acknowledgments still need to flow unimpeded because disruptions present as delayed revenue, missing or delayed shipments, and SLA violations, as well as fines and penalties.

Q3: What is a Transition Service Agreement (TSA)?

A: A TSA is a temporary agreement in which the seller continues providing specific services or system access after the deal closes, so the buyer can maintain continuity while transitioning to the future state environment.

Q4: How do TSAs relate to EDI/B2B integration continuity?

A: TSAs can keep critical integration dependencies in place—connectivity, access to systems, or operational support. This gives the acquiring organization time to stabilize dual-run operations and plan platform consolidation without breaking partner-facing flows.

Q5: How should a merged company decide which EDI/B2B integration platform to keep?

A: Use an M&A-weighted scorecard focused on continuity and operability: Day One disruption risk, partner and protocol coverage, operational maturity, security/compliance readiness, skills supportability, and total economics (including migration and decommission costs).

Sources:

Knowledge at Wharton – Why Many M&A Deals Fail and How to Beat the Odds

https://knowledge.wharton.upenn.edu/article/why-many-ma-deals-fail-and-how-to-beat-the-odds/

Deloitte – M&A Integration Plan for Day One Readiness

https://www.deloitte.com/us/en/services/consulting/articles/mergers-acquisitions-integration-plan-checklist.html

Remedi – Remedi Delivers Programmers with RPG and CL Experience

https://www.remedi.com/solutions-remedi-edi-mft-eai-and-api-solution-summaries/remedi-delivers-programmers-with-rpg-and-cl-experience

Deloitte – The Art of Transition Service Agreement Negotiations

https://www.deloitte.com/us/en/what-we-do/capabilities/mergers-acquisitions-restructuring/articles/recommendations-for-transition-service-agreement-negotiations.html

CIO Council / CIO.gov – The Application Rationalization Playbook

https://www.cio.gov/assets/files/Application-Rationalization-Playbook.pdf

SEEBURGER – The Ultimate Integration Glossary by SEEBURGER

https://www.seeburger.com/resources/good-to-know/the-ultimate-integration-glossary-by-seeburger